Orchestrating the Yes:

The committee is the customer

By Marco Diaz, September 18, 2025

The deal looked done. A director in operations had the slide with the green check mark; the platform vendor had the verbal. Then Legal spotted a data-handling blind spot. Security balked. Finance asked for “one more” analysis, the sponsor went dark, and urgency leaked out of the room like air from a tire. By the time the committee reconvened, the quarter had closed—and so had the window.

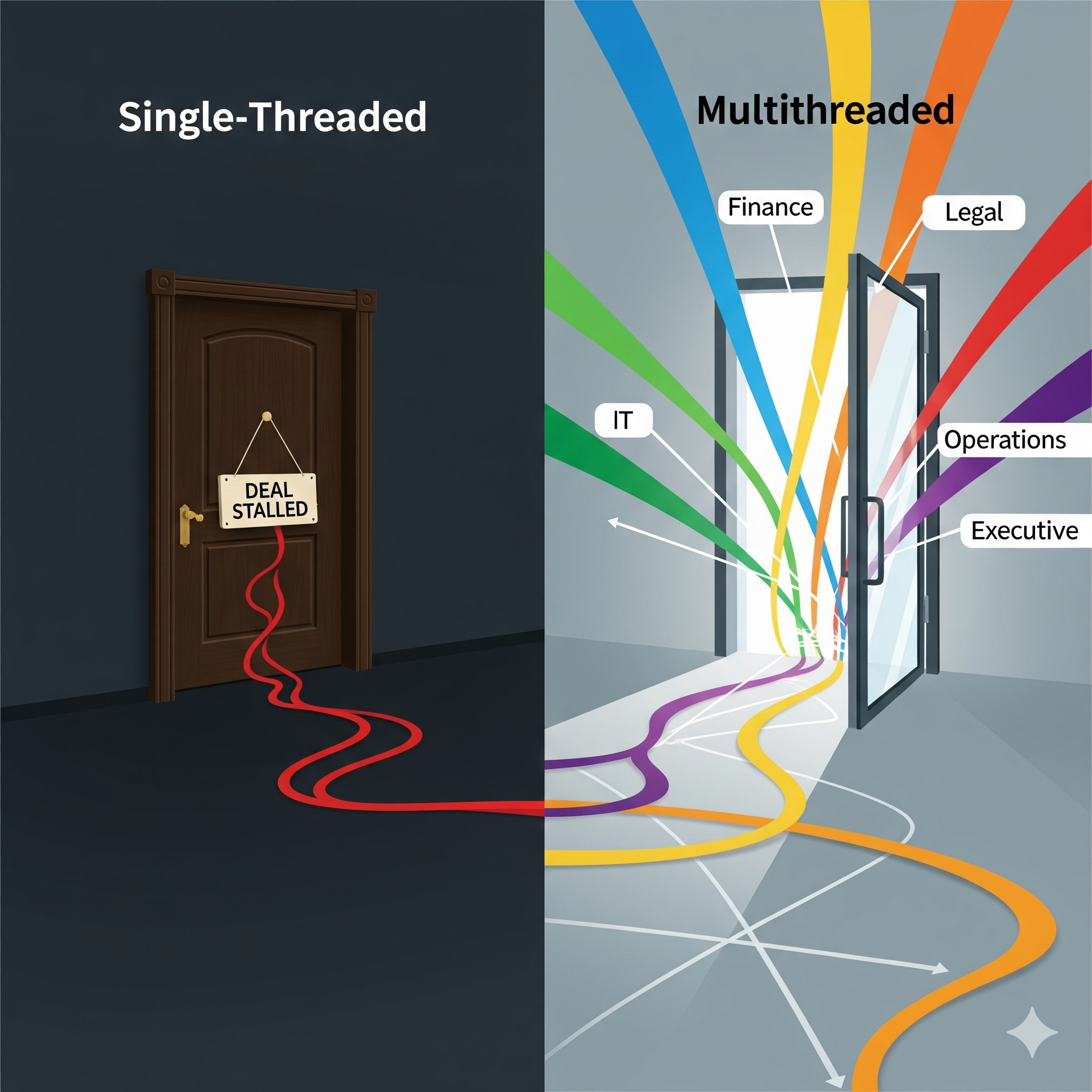

Enterprise buying isn’t a funnel; it’s a committee drama. The central plot point isn’t price or a perfect demo. It’s whether the seller (and the internal champion) can turn a crowd of functions: finance, risk, security, procurement, users; into a single, time-bound “yes.” Single-threaded deals don’t usually die of “no.” They die of drift.

The committee is the channel

Across categories, buyers say the journey is hard: most report their latest purchase felt complex, and typical buying groups involve six to ten stakeholders, or more, each arriving with their own pile of research to reconcile. That’s not “marketecture”; it’s table stakes for how decisions get made now.

The practical consequence is brutal for lone-contact selling. If your only champion can’t carry the case through security review, finance hurdles, and legal risk, the deal inherits their limits. Committees don’t outsource conviction to one person, and they certainly don’t outsource risk.

Drift is the default

Timelines aren’t infinite, but they’re long enough for momentum to bleed out. In the tech sector, a clear majority of buyers finish within six months; yet the share is smaller in enterprise, and many decisions stretch toward the one-year mark as new questions arise and stakeholders rotate in. Every re-open adds friction. The journey is non-linear by design; buyers loop back to revisit requirements or supplier fit when risk surfaces late.

Single-threading magnifies that risk. The fewer voices you’ve aligned early, the more likely a late “just checking” from security or finance becomes a quarter-slipping detour.

Surface area predicts outcomes

The antidote is not more activity; it’s more consensus surface area—purposeful contact across functions early enough to expose objections while they’re cheap to fix. The data is unromantic: when sellers engage more than one contact, deals are significantly more likely to close; when they truly multithread, win rates jump… dramatically so on larger ACVs. The pattern shows up across multiple large datasets tracking millions of seller–buyer interactions.

What top teams actually do is widen the thread with intent. They don’t “spray” meetings; they sequence a few decisive conversations that let Security state its minimum viable controls, let Finance shape value ranges before price anchors, and give the executive sponsor a brief that could survive a board packet.This is not “more meetings.” It’s governance.

Enterprise committees say “yes” through gates, not vibes. Security needs a defensible control posture. Legal wants data-handling clarity. Finance wants a bounded model tied to payback norms. Procurement wants a process it can defend. Sellers who treat these as paperwork at the end of a sprint get what they deserve: delays that feel like surprises but were entirely predictable.

The teams that close design for the gates. They surface risk early, tie commercial structure to governance, and keep a single narrative artifact, often a one-page decision brief, current as the committee’s story of itself. The by-product is speed, not because shortcuts were taken, but because no one has to restart the argument every time a new stakeholder joins.

A scene from the middle of the movie

Watch a good multithread in flight and you’ll see choreography, not chaos. An executive problem-alignment call produces plain-language stakes and timing. A short risk workshop makes Security and Legal co-authors of the solution’s control story. A value session with Finance sets ranges and guardrails, so later price conversations have a place to land. None of this is performative. It’s insurance against drift.

What it means for executives (and your champion)

Manage variance, not just velocity. Multithreading reduces last-mile surprises; your forecast gets cleaner because your committee has already argued with itself.

Expose risks while they’re cheap. Early engagement with Security/Legal prevents late-stage “unknown unknowns” that derail quarters.

Narrative beats numbers (until numbers are framed). A crisp decision brief precedes a credible model; otherwise Finance is evaluating a price, not an investment.

The metric that matters: track deals with multiple active contacts vs. single-threaded. Your win-rate delta will look eerily like the industry’s.

The return to our opening scene

The vendor in that first paragraph didn’t get cheaper or flashier. They got wider and earlier. Security wrote the control story with them. Finance tuned ranges before numbers calcified. The sponsor borrowed the language from the brief for a board pre-read. The contract didn’t close because of a hero seller; it closed because a committee could finally say “yes” once.

Sources

Gartner on buying complexity and 6–10 stakeholder groups; information overload and non-linear jobs in the journey.

TrustRadius “2024 B2B Buying Disconnect” on cycle lengths (majority ≤6 months; lower share for enterprise).

Outreach analyses on higher close likelihood with >1 engaged contact (37% figure; 2024 updates).

Gong Labs on multithreading’s win-rate lift, especially on $50K+ deals.