PIBAT: A Practical System

for Moden B2B Deal Qualification

By Marco Diaz, February 10, 2025

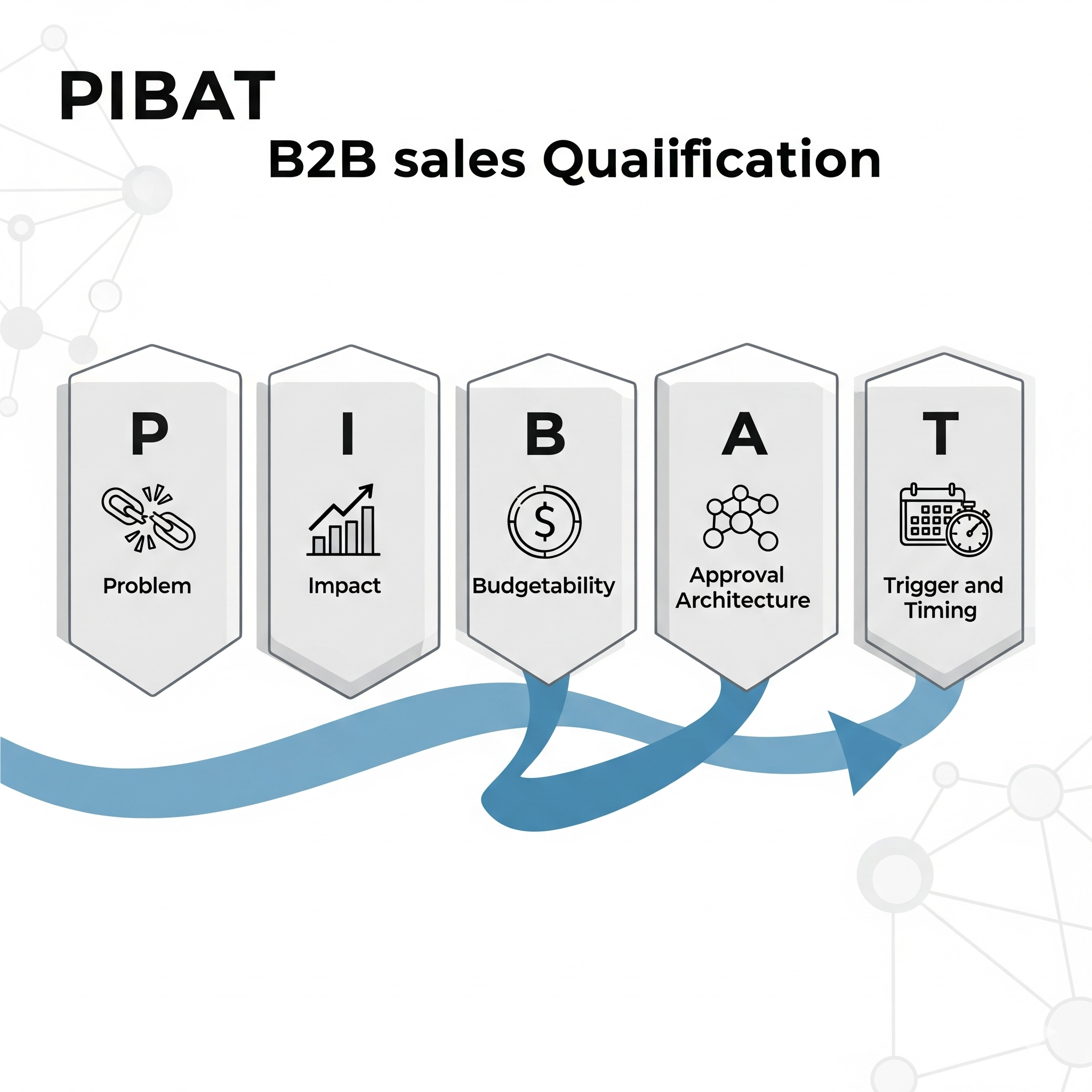

Buying groups are bigger, budgets are fluid, and “authority” is a maze of gates—not a single signer. PIBAT gives revenue teams a shared, evidence-led way to qualify and advance deals: Problem, Impact, Budgetability, Approval Architecture, Trigger & Timing. The rule is simple — raise the lowest score within 14 days — and the result is cleaner forecasts, fewer stalls, and faster decisions.

The buying reality (and why old playbooks stall)

Enterprise and upper mid-market decisions rarely hinge on one executive. Security, networking, compliance, procurement, finance, legal, and IT each need a “yes,” often in a specific order. Meanwhile, funds aren’t always a line item—they’re a reallocation, a consolidation, or an OpEx/CapEx fit timed to a fiscal window. Traditional qualification frameworks tell you to find pain, metrics, and a buyer; PIBAT goes further by hard-wiring how deals actually move across functions and budgets.

Meet PIBAT

P — Problem: the concrete pain, risk, or constraint as the customer experiences it.

I — Impact: the quantified business consequence (revenue, cost, risk/compliance, CX) with named KPI owners.

B — Budgetability: how fundable the initiative is—GL path, reallocation options, fiscal timing, OpEx/CapEx fit.

A — Approval Architecture: who signs, who influences, who can veto—and the gate order (security → networking → compliance → procurement → finance → legal/IT), with pre-reads and dry-runs scheduled.

T — Trigger & Timing: the forcing function (audit, renewal, launch, incident, board) and its proximity, plus a latest no-go date and dependencies (freezes, maintenance, cutovers).

Operating rule: raise the lowest PIBAT subscore by one within 14 days. That cadence keeps momentum and focuses effort where the deal is truly weak.

How it works (anchored, not opinion-based)

PIBAT uses a 0–3 rubric for each dimension:

0 = not established

1 = directional only

2 = defined with named owners and a credible path

3 = validated with artifacts (e.g., finance-signed model, scheduled gate pre-reads, dated trigger <30 days)

Evidence beats opinion.

Every score is anchored to artifacts (verbatims, ticket IDs, baseline metrics, GL codes, scheduled pre-reads, calendar invites). If your evidence is >21 days old, downgrade the subscore by 1.

Stage gates you can enforce in CRM:

Discovery → Validate: P≥2 and I≥2

Validate → Proposal: A≥2 and B≥2

Proposal → Commit: T≥2 and Total≥10, with A=3 or T=3

This removes “stage creep” and ties progression to proof instead of optimism.

What “good” looks like (the Definition of Done)

P — Problem: customer verbatim + incident/ticket or risk-register ID + baseline metric.

I — Impact: 12-month value model with assumptions, named KPI owner, and cost of delay (CoD) per week.

B — Budgetability: GL/budget code or reallocation source; OpEx/CapEx classification; fiscal window mapped to procurement lead times.

A — Approval Architecture: signer + ≥3 influencers across ≥2 functions; gate order with pre-reads and one dry-run scheduled; champion and blocker stances documented.

T — Trigger & Timing: dated trigger, latest no-go, and a dependency calendar (freezes, maintenance, board cycles).

Triggers > timelines: make urgency real

Timelines slip; triggers don’t. PIBAT treats urgency as event-driven:

Hard (<30 days)

Firm (30–90)

Plausible (>90).

If the trigger is below Firm, cap T at 2 and plan an access move or a new forcing function.

Cost of Delay (fast math):

CoD per week = (ΔKPI × $ per KPI unit) ÷ 52

Add risk-adjusted impact for outages or compliance exposures. Put the CoD number on your 1-pager and reference it in executive emails.

Buyer-centric momentum: the Mutual Action Plan (MAP)

A good MAP is co-owned with the buyer and mirrors their gate order:

Skeleton: Objectives → Milestones (aligned to gates) → Owners (Buyer/Seller) → Artifacts (pre-reads, control evidence, PoC plan) → Dates → Risks → Backstops.

Quality bar: Buyer owns ≥50% of milestones; each milestone ties to a gate and has a dated artifact; risky steps include backstops.

MAPs remove ambiguity, keep calendars honest, and make forecasting saner.

Where PIBAT fits among familiar frameworks

If you already know MEDDIC/MEDDPICC or SPICED, PIBAT will feel natural. It complements those frameworks by making Budgetability, Approval Architecture, and Trigger explicit, scoreable levers, and by insisting on gate-specific artifacts and CRM validation rules. In short: it operationalizes what great sellers and SEs do intuitively, at team scale.

Implementation in 30–60–90 days

0–30 (Foundation)

Configure CRM fields and validation rules; introduce the rubric and artifacts; run two enablement sessions (AE/SE + managers); pilot on five opportunities.

31–60 (Scale)

Add dashboards (lowest subscore, trigger proximity, MAP slippage). Enforce stage gates. Build a library of 10 strong artifacts for calibration.

61–90 (Optimize)

Feed an audit/renewal calendar into Trigger scoring. Review win/loss lessons monthly. Tighten the DoD and keep the evidence fresh.

A composite example (how a stalled deal moves)

Before: P=1, I=1, B=1, A=1, T=1. An enthusiastic user, no finance validation, one champion, and a “Q4 ish” target.

After two weeks on PIBAT: P=2 (verbatims + baseline), I=2 (model + KPI owner), B=2 (GL path + OpEx), A=2 (signer + 3 influencers mapped, security pre-read booked), T=2 (renewal 74 days out, Firm).

Next 14 days: Finance validation (aim I=3) and pre-reads for security and procurement (aim A=3). The MAP now shows buyer-owned milestones and backstops.

Anti-patterns to avoid

Fake urgency: no dated trigger or CoD math.

Single-threading: one contact ≠ Approval Architecture.

“Do you have budget?” vs Budgetability: find GL codes, reallocation sources, fiscal windows.

Seller-centric planning: if the buyer doesn’t co-own the MAP, it isn’t a plan.

Kill criteria (disqualify fast):

T=0 for 60 days; A=0 after two failed multithreading attempts; B=0 when Finance confirms no reallocation or current-year funds.

Get started

Download the PIBAT Toolkit (EN/ES): scorecard, approval map, triggers library, deal summary, PIBAT-Lite.

Read the Field Manual (EN/ES): full rubric, artifacts, stage gates, MAP, CoD, playbooks.

Run a “lowest-subscore” pipeline review: 15 minutes per deal. Choose one move due in 14 days—owner, artifact, date.

Call to action: Want help enabling your team or mapping PIBAT into your CRM? Book a working session with ESO. We’ll calibrate the rubric to your segments, add validation rules, and kick off a live MAP on an active opportunity.

FAQ (for skeptics and realists)

Is PIBAT just another acronym?

No—it’s a runbook with artifacts and CRM guardrails. If you can’t attach the evidence, you can’t move the stage.

Will this slow us down?

It accelerates the right work and kills the wrong work sooner. The 14-day rule focuses effort where the deal is weak.

We already use MEDDIC. Why add PIBAT?

Keep MEDDIC for discovery depth. Use PIBAT to operationalize approval gates, funding paths, and trigger-driven timing—with evidence and stage rules.

Resources

PIBAT Field Manual: The definitive guide to implementing PIBAT: anchored 0–3 rubric, evidence standards (DoD), CRM stage-gates, MAP quality bar, CoD math, playbooks, and a 30–60–90 rollout plan.

PIBAT Toolkit: Ready-to-use templates—Scorecard, Approval Map, Trigger Library, Deal 1-Pager, and PIBAT-Lite—to operationalize PIBAT in pipeline reviews and execution.